Is Upstart legit? That's the question on quite a few peoples minds. Upstart is a new lending platform that has been making waves in the business and investment industries. But is it as great as everyone says it is? Or is it just another scam?

We're here to tell you that, yes, Upstart is indeed legit. In this blog post, we'll look at Upstart and see if it might be a good choice as your lender. Stay tuned to find out more!

What is Upstart?

Upstart is a lending company that offers personal loans to individuals who need money for any purpose. Founded in 2012, with headquarters in San Carlos, California, Upstart has funded over $28.6 billion in loans.

Upstart offers competitive interest rates and fast funding times, making it a great option for borrowers who need money quickly. In addition, Upstart's underwriting model considers factors beyond the credit score so that they can approve more borrowers than traditional lenders.

As a result, Upstart is one of the most popular lending platforms available today.

“Upstart is a lending platform that leverages artificial intelligence and machine learning to price credit and automates the borrowing process.” – Upstart Website

Upstart personal loans at a glance

If you're looking for a personal loan, Upstart may be a good option. Here's what you need to know about Upstart loans at a glance.

Upstart offers fixed-rate personal loans so that you know your monthly payments will never go up.

Loan terms range from 36 to 60 months. You can borrow from $1,000 to $50,000 with an Upstart loan.

One of the benefits of an Upstart loan is that it can be used for various purposes, including consolidating debt, paying for home improvements, or funding a small business.

To apply for an Upstart loan, you'll need to complete an online application. Once approved, you'll receive your loan funds into your bank account in as little as one business day.

If you're looking for a personal loan with quick funding and no hidden fees, Upstart makes it easy to get the money you need.

How does Upstart work?

Upstart is a financial technology company offering simple payment terms and low-interest rates personal loans. But how does Upstart work?

Upstart uses artificial intelligence and machine learning to assess a borrower's creditworthiness. This helps Upstart to make decisions about loan approval and pricing that are more accurate than traditional methods.

As a result, borrowers with good credit can get lower interest rates, and those with poor credit can still get approved for a loan.

Once a loan is approved, the funds are deposited into the borrower's bank account within one to two business days.

Upstart is a great option to consider if you're looking for affordable credit. With its simple application process and competitive interest rates, Upstart can help you get the funds you need without the hassle.

How can Upstart personal loans be used?

When it comes to personal finance, there are a lot of options out there for how to get money. You can go to a bank and get a loan or find an investor to give you some seed money.

But what if you need money right now and don't have the time to go through all of that? With Upstart, you only need to complete the automated application process and provide the documentation they request.

So what can you use Upstart personal loans for? Pretty much anything! You can use the loan proceeds to start a business, pay off some debts, cover education-related expenses or even just take a much-needed vacation.

The possibilities are endless. So if you need some quick cash, don't be afraid to look into getting an Upstart personal loan. It could be just what you need to get your financial life back on track.

Who is Upstart best for?

Upstart is best for people with a good credit history and a steady income. If you have a job and make on-time payments, you will likely get approved for a loan with Upstart. Even if you don't have perfect credit, you may still be able to qualify for a loan from Upstart.

The company uses an algorithm to look at factors like education and employment history to determine your eligibility. So, if you're looking for a personal loan and haven't always had good financial habits, Upstart may still be an option available to you.

How to qualify for an Upstart personal loan?

Upstart offers personal loans with a simple online application and a quick approval process. Here's what you need to know to qualify for an Upstart loan.

First, you'll need to be at least 18 years old and a U.S. citizen or permanent resident with a steady source of income. You'll also need to have a valid Social Security number and a checking account in your name.

To get started, you'll need to provide basic information about yourself and your finances. Upstart will then use a proprietary algorithm to evaluate your creditworthiness. This process considers factors such as your education and employment history, as well as your credit score.

If you're approved, you'll be able to choose the loan amount and repayment term that best suits your needs. Once you've accepted the loan agreement, the money will be deposited directly into your checking account within 1-2 business days.

So if you're looking for a personal loan with fast approval and flexible repayment options, Upstart may be the perfect lender for you!

What credit score should I have?

When it comes to personal loans, your credit score is one of the most important factors that lenders will consider. A high credit score shows that you're a responsible borrower, which means you're more likely to repay your loan on time.

On the other hand, a low credit score indicates that you're a higher-risk borrower, which could make it more difficult to get approved for a loan. So, what credit score should you have for an Upstart personal loan?

Generally speaking, the higher your credit score, the better your chances of getting approved for a loan with favorable terms. However, it's important to remember that your credit score is just one factor that lenders will consider when making a decision.

Other factors, such as your income and employment history, will also be taken into account. So even if your credit score isn't perfect, you may still be able to get approved for an Upstart personal loan, but the interest rate is likely to be higher.

Upstart Fees

Upstart charges origination fees of 0% to 10%, depending on the loan amount and length of the repayment term. This is a typical fee charged by many personal loan lenders, and it helps to cover the costs associated with originating and administering the loan.

The good news is that Upstart does not charge any early repayment penalties, so you can pay off your loan early at any time without penalty.

Where Upstart personal loans fail

Upstart personal loans have become increasingly popular in recent years, as they offer a way to consolidate debt or finance a large purchase without going through a traditional bank. However, Upstart loans are not without their drawbacks.

One common complaint is that interest rates can be high if you don't have a great credit history. Lower rates on Upstart loans are typically only available to those with good or excellent credit scores, which may exclude some potential borrowers.

The interest rates for these loans can vary depending on your state. Some states have a limit on how high the interest rate can be, while others do not have any limit. It's important to compare the offers you receive from different lenders to ensure you get the best deal.

Another downside is that loans for particular purposes are not available in all states. For instance, with regard to auto refinancing, Upstart currently only offers this for Florida residents with cars registered in the state of Florida.

While they have their shortcomings, Upstart loans can still be a good option for those who can qualify and are comfortable with the interest rates.

Reviews

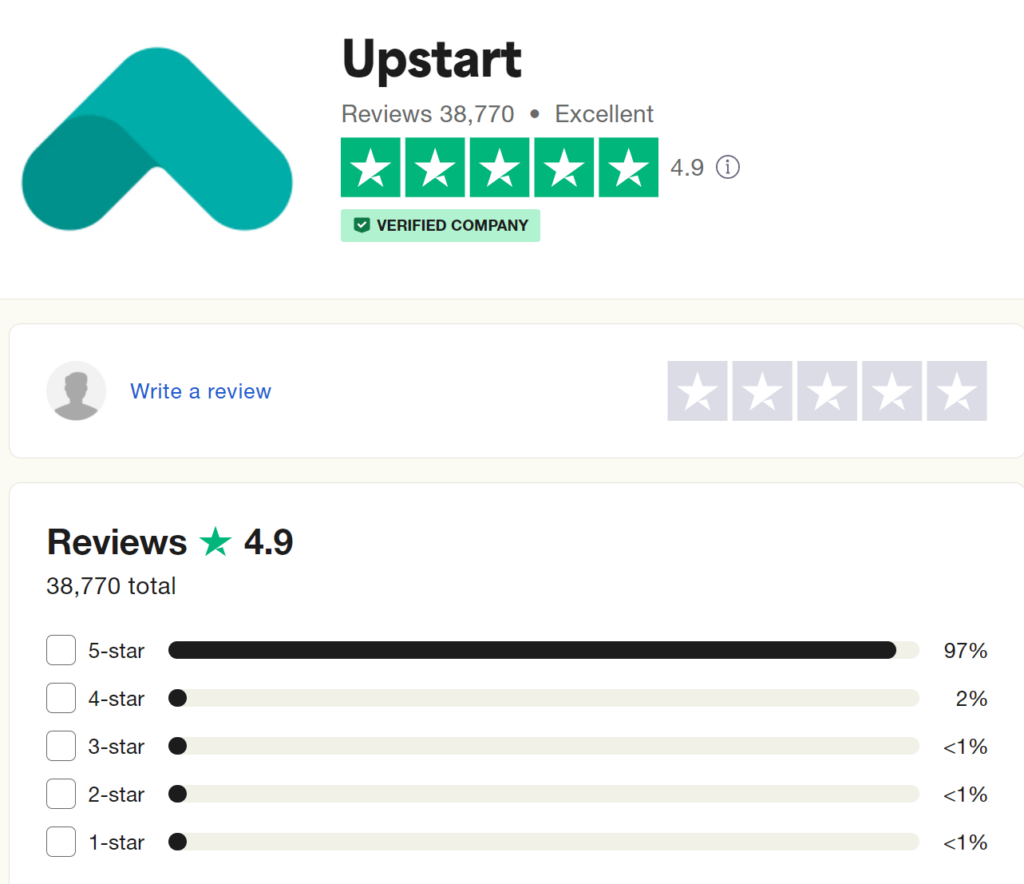

Any business will tell you that reviews and ratings are essential for gauging success. They provide valuable customer feedback and help improve the product or service. And regarding online reviews, few businesses have a better rating than Upstart.

With a Trustpilot ranking of 4.9, Upstart is considered to be excellent by its customers. But what is it that sets Upstart apart from other businesses?

For starters, Upstart is a relatively young company that is quickly making a name for itself in the lending industry. Its innovative approach to business has won it many fans, and its commitment to customer service is second to none.

Upstart offers loans to individuals, small businesses, and startups who might not qualify for traditional bank financing. The company uses a unique underwriting model that considers factors like education and job history, not just credit scores.

This has helped many businesses get the funding they need to grow and succeed.

So if you're looking for an alternative to traditional bank financing, check out Upstart. With its excellent Trustpilot ranking, you can be confident that you're getting a quality product from a company that cares about its customers.

How is Upstart's customer service?

Although the company aims to automate the loan application process as much as possible, a customer service team is still available to help with any questions or issues that may arise.

The company offers a comprehensive help section on its website, and email and phone support from 9am-8pm. Reviews of Upstart's customer service are excellent, and borrowers have praised them for their knowledge and professionalism.

Upstart alternatives

Upstart is not the only lender in the market, and several alternatives are available. Listed below are some of the most popular options:

LendingClub

LendingClub is a good alternative for businesses and individuals looking for a personal loan. The company offers loans of up to $40,000 and terms of 3 or 5 years.

LendingClub's interest rates are competitive, and its application process is simple and straightforward.

Funding Circle

Funding Circle is a great alternative for businesses that are looking for a loan but don't have the best credit score. The company doesn't have a minimum credit score requirement, which makes it more accessible to a wider range of businesses.

Additionally, Funding Circle offers loan terms of 1-5 years, which gives borrowers more flexibility in how they repay the loan.

Kabbage

Kabbage is another solid alternative for businesses that are looking for a loan but don't have the best credit score. One of the things that sets Kabbage apart from other loan providers is its focus on small business owners.

They understand that it can be difficult to get access to capital, and they work hard to provide financing options that meet the needs of small businesses. If you're looking for a lender that is dedicated to helping small businesses succeed, Kabbage may be a good option for you.

Check out our article if you need to start a business with no money.

Is Upstart legit? Final thoughts…

Upstart is a great option for businesses and individuals looking for an alternative to traditional bank financing. The company uses a unique underwriting model that takes into account factors like education and job history, not just credit scores.

This has helped many businesses get the funding they need to grow and succeed, as well as help individuals with bad credit get access to personal loans. Upstart is a legitimate company with an excellent Trustpilot ranking, and its customer service is second to none.

If you're looking for an alternative to traditional bank financing, you could do a lot worse than check out Upstart.

The post Is Upstart Legit for Affordable Borrowing? We’ve Got The Answer! appeared first on Niche Pursuits.